How to Cancel a Transaction From My Bank Account? In today’s fast-paced digital world, financial transactions are completed in seconds. While this efficiency has brought numerous conveniences, it also comes with a downside: the occasional need to cancel a transaction. Whether it’s a mistake, a change of mind, or a fraudulent activity, understanding how to effectively cancel a bank transaction can save you time, money, and stress. This guide delves into the various scenarios and steps you can take to address this issue, ensuring you’re well-equipped to handle such situations.

The Basics of Transaction Cancellations

Before diving into the specifics, it’s essential to understand that the ability to cancel a bank transaction depends on two key factors:

- The Type of Transaction: Transactions can vary from debit card purchases and credit card payments to bank transfers. Each type has distinct rules and processes for cancellations.

- The Timing of the Transaction: Transactions are typically categorized into two stages: pending (authorized but not yet processed) and posted (already processed). The stage at which your transaction stands will determine your options.

Let’s explore the different scenarios and what you can do in each case.

Pending Transactions (Authorized but Not Yet Processed)

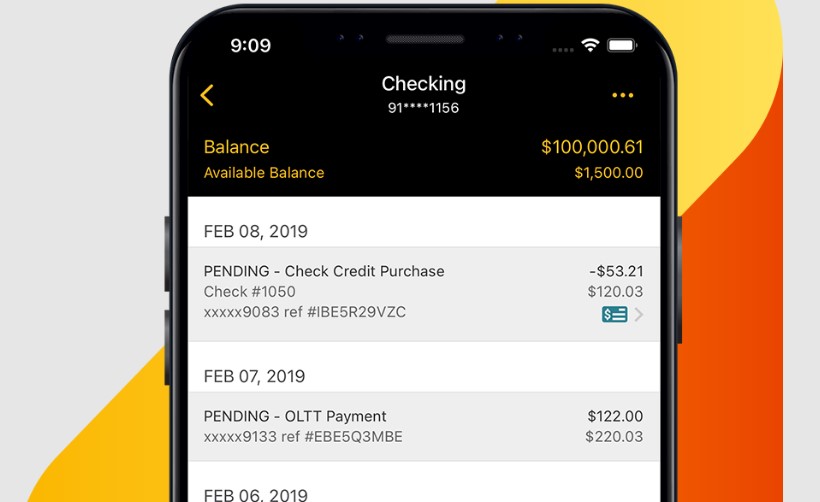

Pending transactions are those that have been authorized by your bank but have not yet been fully processed or settled. These transactions appear on your account as “pending” and are usually the easiest to cancel. Here’s what you can do:

1. Contact the Merchant

The most direct and effective way to cancel a pending transaction is to contact the merchant involved. Here’s how:

- Explain the Situation: Inform the merchant about the reason for cancellation, whether it’s due to a mistake, change of mind, or another issue.

- Request Cancellation: Ask the merchant to cancel the authorization directly. Merchants often have the ability to void a transaction before it is processed fully.

- Get Confirmation: Ensure you receive written or email confirmation from the merchant to verify that the cancellation has been completed.

2. Seek Assistance from Your Bank

If contacting the merchant is unsuccessful or not feasible, you can turn to your bank for help. Banks have protocols to handle pending transactions. Here’s what you should do:

- Provide Transaction Details: Be ready to share the transaction date, amount, merchant name, and any reference numbers.

- Explain the Urgency: Highlight that the transaction is still pending and emphasize the need for immediate action.

- Follow Up: Request updates from the bank to ensure that the authorization has been canceled successfully.

Posted Transactions (Already Processed)

Posted transactions are those that have already been processed and settled in your account. Canceling these transactions is more complex but not impossible. Here are your options:

1. Dispute the Charge

If you believe the transaction is fraudulent or was made in error, you can file a dispute with your bank. This process, commonly referred to as a “chargeback,” involves the following steps:

- Contact Your Bank Immediately: Most banks have specific timeframes for filing disputes, so acting quickly is crucial.

- Provide Supporting Evidence: Gather receipts, emails, or any documentation that supports your claim.

- Follow the Bank’s Process: Banks typically have a dispute resolution team that will investigate the issue and work to reverse the charge if your claim is valid.

2. Contact the Merchant for a Refund

If the transaction is legitimate but you wish to cancel it due to dissatisfaction with goods or services, reach out to the merchant directly. Here’s what you can do:

- Request a Refund: Explain your reason for seeking a refund, whether it’s due to a defective product, poor service, or a change of mind.

- Provide Proof of Purchase: Show your receipt or any other documentation that confirms the transaction.

- Follow Up: Merchants may take time to process refunds, so maintain regular communication to track progress.

Important Considerations for Cancelling Transactions

Canceling a bank transaction is not always straightforward. Here are some critical factors to keep in mind:

1. Transaction Type

The cancellation process may vary based on the type of transaction:

- Debit Card Transactions: These often have a short window for cancellation while they’re pending.

- Credit Card Transactions: Credit cards offer more robust protection, including the ability to file chargebacks for disputes.

- Bank Transfers: Cancelling a bank transfer can be challenging, especially for international or same-day transfers.

2. Bank Policies

Each bank has unique policies regarding transaction cancellations. It’s essential to:

- Review your bank’s terms and conditions.

- Contact your bank’s customer service for specific guidance.

3. Timeliness

Acting promptly is critical when canceling transactions. The sooner you take action, the higher your chances of success.

Information You’ll Need to Cancel a Transaction

To expedite the cancellation process, gather the following information:

- Transaction Details:

- Date of the transaction.

- Amount charged.

- Merchant name.

- Reference or authorization numbers.

- Your Bank Account Information:

- Account number.

- Contact details associated with your account.

- Supporting Documents:

- Receipts, invoices, or emails related to the transaction.

Mistakes and unexpected situations happen, but knowing how to cancel a bank transaction can make all the difference. Whether you’re dealing with a pending or posted transaction, acting quickly and understanding your options are key. Always maintain detailed records of your transactions and be proactive in resolving any issues. With these strategies, you can navigate the complexities of transaction cancellations with confidence and ease.