How To Cancel A Money Order? – Cancelling a money order can be a necessary step for various reasons, such as loss, fraud, or a change of plans. Unlike checks, money orders are prepaid, meaning they are a secure form of payment since the funds are already guaranteed. However, if the money order has not yet been cashed or deposited, you may still have the option to cancel it. This article outlines the process of cancelling a money order, the essential steps to follow, and important things to consider when requesting a cancellation.

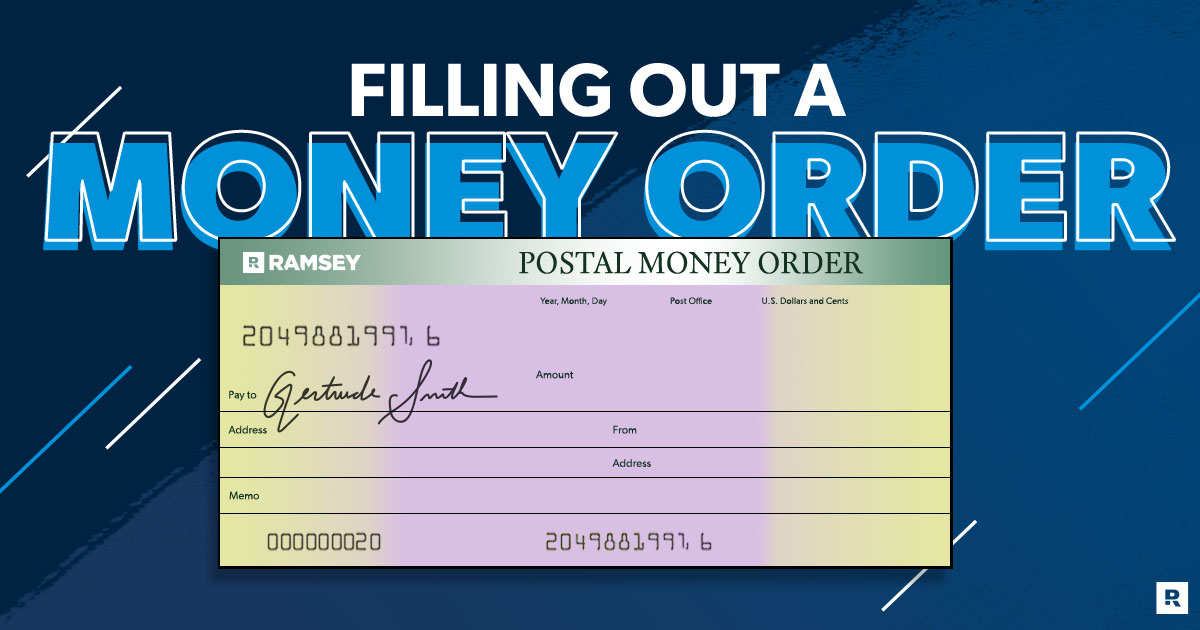

A money order is a prepaid form of payment that allows individuals to send funds to another party without using personal checks. It is a secure way of making a payment, as the issuer guarantees the funds are available upfront. Money orders can be purchased from various sources such as the U.S. Postal Service (USPS), Western Union, MoneyGram, and other financial institutions.

Money orders are typically used in situations where a personal check is not accepted, or when the sender does not have a checking account. The recipient can cash or deposit the money order at their bank, and unlike a personal check, money orders cannot be bounced due to insufficient funds.

How To Cancel A Money Order?

If you find yourself needing to cancel a money order, whether due to loss, theft, or an error in the transaction, it’s important to understand the necessary steps to ensure the process goes smoothly. Cancelling a money order typically involves contacting the issuer, providing specific details about the transaction, and following their guidelines for requesting a cancellation. While it may not always be possible to cancel a money order that has already been cashed, acting quickly can help you stop the payment before it’s too late. This guide will walk you through the steps involved in cancelling a money order and the key considerations to keep in mind.

Cancelling a money order involves contacting the issuer, verifying your purchase details, and paying any applicable fees. Below is a comprehensive guide on how to go about it:

Step 1: Contact the Issuer

To cancel a money order, you need to reach out to the organization that issued it. The steps can vary slightly depending on whether you purchased the money order through the U.S. Postal Service (USPS), Western Union, MoneyGram, or another provider.

- USPS Money Orders: If you purchased the money order from the U.S. Postal Service, you will need to contact the USPS directly. You can do so by visiting the post office where the money order was purchased. Alternatively, you can contact USPS customer service for instructions on how to proceed with the cancellation.

- Western Union or MoneyGram: For money orders purchased through Western Union, MoneyGram, or other providers, you will need to contact the issuer’s customer service department or visit the location where the money order was purchased. Each of these services has specific cancellation procedures, so contacting them directly will provide the most accurate guidance.

Step 2: Provide the Required Information

When contacting the issuer, you’ll need to provide several key pieces of information in order to process the cancellation:

- Money Order Number: This is a unique identifier that is printed on the money order. It is one of the most important pieces of information needed to locate and cancel the order.

- Purchase Date and Location: Be prepared to provide the exact date and location where the money order was purchased. This helps the issuer verify the transaction and confirm that the request is legitimate.

- Your Identification: Most issuers will require you to provide a valid ID to ensure you are the rightful purchaser of the money order. You may be asked to show a driver’s license, passport, or another form of government-issued identification.

- Reason for Cancellation: While not always required, you may be asked to explain why you are requesting the cancellation. This can help the issuer understand the situation and expedite the process.

Step 3: Complete a Cancellation Form

In most cases, the issuer will provide you with a cancellation form that you need to complete. The form will ask for basic information such as your name, contact details, money order number, amount, and any other relevant data.

Carefully fill out the form and sign it where required. Some issuers may offer to help you complete the form if you are unsure about any of the details.

Step 4: Pay the Cancellation Fee

Issuers typically charge a fee for processing a money order cancellation. The fee can vary depending on the issuer and the type of money order. On average, cancellation fees range from $10 to $25. It’s essential to ask about the specific fee when you contact the issuer to ensure you’re prepared.

Remember, this fee is non-refundable, and it may be deducted from the total amount of the money order if you receive a refund.

Step 5: Wait for the Processing

Once you’ve completed the necessary steps, the cancellation request will be processed by the issuer. The time it takes to process a cancellation can vary depending on the issuer, but it typically takes several business days. If you are entitled to a refund, it will be issued after the cancellation has been processed.

If you need to check the status of your cancellation request, you can follow up with the issuer’s customer service department.

Important Considerations When Cancelling a Money Order

There are several key factors to keep in mind when canceling a money order:

- Timeliness: It’s crucial to initiate the cancellation as soon as possible. The longer you wait, the more likely the money order will be cashed. If the money order has already been cashed or deposited, you will not be able to cancel it.

- Cashed Money Orders: If the money order has already been cashed or deposited, cancellation is not possible. In this case, you may need to pursue other options, such as reporting fraud or disputing the transaction.

- Refunds: Once your cancellation is processed, you will typically receive a refund for the amount of the money order, minus the cancellation fee. The refund may be issued in the form of a check or a credit to your account, depending on the issuer.

- Issuing Bank’s Policy: Each issuer may have slightly different cancellation policies. Always refer to the specific terms and procedures provided by the issuer to ensure the process is carried out correctly.

- Cancellation is Final: After your money order has been successfully canceled, the transaction is final. You won’t be able to reverse the cancellation, so make sure you want to proceed before submitting the request.

Canceling a money order can be a straightforward process as long as you act quickly and provide all the necessary information to the issuer. Whether it’s due to a lost or stolen money order, a mistake on your part, or a change of plans, understanding how to cancel a money order can help protect you from financial loss.

While the cancellation process may involve a fee and some paperwork, it’s a useful option to have if you need to stop a payment. Always be sure to contact the issuer directly for the most accurate and up-to-date information, and take action as soon as you realize there’s a need to cancel the money order.

By following the outlined steps, you’ll be able to cancel your money order efficiently and effectively, ensuring that your funds are protected.